Unlocking Financial Freedom

In today’s fast-paced world, financial stability often seems just out of reach. Whether you’re a student, a working professional, or simply someone looking to boost your income, the idea of earning money while you sleep is incredibly appealing.

Enter passive income—a financial strategy that allows you to earn money with little to no active involvement.

If you’re new to the concept of passive income, don’t worry. This guide will walk you through 21 beginner-friendly ideas to get you started on your journey to financial independence.

1. Invest in Dividend Stocks

Dividend stocks are shares in companies that regularly return a portion of their profits to shareholders as dividends. These payments are typically distributed quarterly and can provide a steady stream of income.

Steps to Get Started:

- Research Dividend Stocks: Start by identifying companies with a strong track record of paying consistent and increasing dividends. Tools like Dividend.com or Yahoo Finance can help you screen for these stocks.

- Open a Brokerage Account: Choose a brokerage platform that offers low fees and a user-friendly interface. Popular options include Vanguard, Fidelity, and Robinhood.

- Diversify Your Portfolio: Don’t put all your money into one stock. Spread your investments across different sectors (e.g., utilities, consumer goods, healthcare) to reduce risk.

- Reinvest Dividends: Opt to reinvest your dividends to buy more shares, which can significantly increase your returns over time through compounding.

- Monitor and Adjust: Keep an eye on your portfolio and make adjustments as needed, such as selling underperforming stocks or buying more of those that continue to do well.

2. Create a Blog or YouTube Channel

Blogging or creating a YouTube channel allows you to share your knowledge, hobbies, or expertise with a global audience. Monetization options include ad revenue, affiliate marketing, sponsored content, and selling products or services.

Steps to Get Started:

- Choose Your Niche: Select a topic you’re passionate about and knowledgeable in. Popular niches include personal finance 💰, travel 🌍, food 🍕, and technology 💻.

- Set Up Your Platform: For blogging, choose a content management system (CMS) like WordPress and purchase a domain name and hosting 🖥️. For YouTube, create an account and customize your channel.

- Create High-Quality Content: Focus on creating valuable, engaging, and unique content that resonates with your target audience. Use SEO strategies to optimize your blog posts for search engines 🔍.

- Promote Your Content: Share your content on social media 📱, join online communities, and collaborate with other bloggers or YouTubers to increase your reach.

- Monetize Your Platform: Once you have a steady stream of traffic or subscribers, apply for ad networks like Google AdSense 💸, join affiliate programs, or reach out to brands for sponsorships 🤝.

3. Write an eBook

Writing an eBook allows you to share your expertise, experiences, or stories with a wide audience. Platforms like Amazon Kindle Direct Publishing (KDP) make it easy to self-publish and reach millions of readers globally.

4. Create an Online Course

Online courses are educational programs that you create and sell through platforms like Udemy, Teachable, or your own website. They can cover a wide range of topics, from technical skills to personal development.

Steps to Get Started:

- Identify a Skill or Expertise: Choose a topic that you have deep knowledge in and that has demand in the market. Popular courses include coding, digital marketing, and photography.

- Plan Your Course Structure: Break down your course into modules and lessons. Create a clear, step-by-step curriculum that guides students through the learning process.

- Create Course Content: Develop videos, quizzes, assignments, and other resources that make your course engaging and informative. Use high-quality audio and video equipment to ensure professional content.

- Choose a Platform: Decide whether to host your course on an established platform like Udemy or Teachable or on your own website. Consider the pros and cons, such as reach, control, and fees.

- Launch Your Course: Once your course is ready, launch it with a marketing plan that includes email campaigns, social media promotions, and collaborations with influencers or affiliates.

5. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for each sale made through your referral link. It’s a flexible and low-cost way to earn passive income, especially if you already have a blog, YouTube channel, or social media following.

Steps to Get Started:

- Choose a Niche: Select a niche that aligns with your interests and expertise. This will make it easier to create content and build trust with your audience.

- Join Affiliate Programs: Sign up for affiliate programs related to your niche. Popular platforms include Amazon Associates, ShareASale, and ClickBank.

- Create Content Around Products: Write blog posts, create videos, or share social media content that reviews or recommends products. Make sure to include your affiliate links.

- Optimize for SEO: Use search engine optimization (SEO) strategies to drive organic traffic to your content. This increases the chances of conversions from your affiliate links.

- Track and Optimize Performance: Use analytics tools to track which products perform best. Optimize your strategy by focusing on high-performing products and improving content that doesn’t convert well.

6. Invest in Real Estate Crowdfunding

Real estate crowdfunding allows individuals to invest in real estate projects with a relatively small amount of money. Platforms like Fundrise and RealtyMogul pool funds from multiple investors to finance real estate developments, offering returns based on rental income or property appreciation.

Is Real Estate Crowdfunding Right for You?

Real estate crowdfunding has emerged as a popular way for individuals to invest in property without the need to buy and manage physical real estate. But is it the right choice for you? Here’s a breakdown to help you decide:

1. Understanding Real Estate Crowdfunding

Real estate crowdfunding involves pooling funds from multiple investors to purchase or finance real estate projects. This can include residential, commercial, or mixed-use properties. In return, investors receive a share of the profits, typically through rental income or property appreciation.

2. Benefits of Real Estate Crowdfunding

- Low Entry Barrier: Unlike traditional real estate investing, which requires significant capital, real estate crowdfunding allows you to start with a relatively small amount of money. Some platforms accept investments as low as $500.

- Diversification: Crowdfunding platforms offer opportunities to invest in various property types and locations, helping you spread risk across multiple investments.

- Passive Income: You can earn regular returns without the hassle of property management. The crowdfunding platform or project developer handles the day-to-day operations.

3. Potential Risks

- Illiquidity: Real estate investments are generally not easily sold or converted to cash. Your money might be tied up for years until the property is sold or the project reaches completion.

- Market Risk: Like any investment, real estate can be affected by market fluctuations. Economic downturns, changes in interest rates, or local market conditions can impact the value of your investment.

- Platform Risk: The success of your investment largely depends on the platform and project developer. If they fail to manage the project effectively, your returns could be negatively impacted.

4. Who Should Consider Real Estate Crowdfunding?

- Beginner Investors: If you’re new to real estate investing and want to test the waters with minimal capital, crowdfunding can be a good starting point.

- Diversifiers: If you’re looking to diversify your investment portfolio with real estate but don’t want to deal with the complexities of direct ownership, crowdfunding offers a hands-off approach.

- Income Seekers: For those interested in generating passive income without managing properties, real estate crowdfunding provides a viable option.

5. Who Should Reconsider?

- Need for Liquidity: If you might need quick access to your funds, the illiquid nature of real estate crowdfunding could be a drawback.

- Risk-Averse Investors: If you’re uncomfortable with market risk or the potential for capital loss, other more stable investments might be a better fit.

- Hands-On Investors: If you prefer to have control over your investments and make decisions about property management, direct real estate ownership might be more suitable.

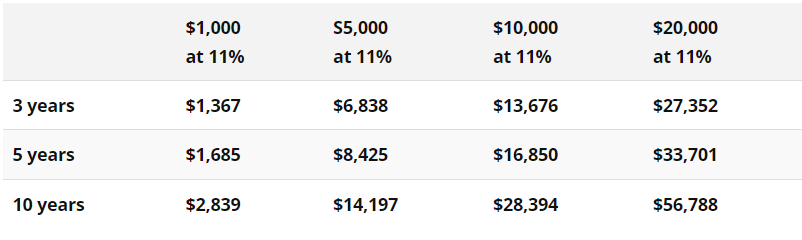

How much money can you make crowdfunding real estate

7. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms like LendingClub and Prosper connect borrowers directly with investors. As an investor, you can lend money to individuals or small businesses in exchange for interest payments, which generate passive income.

8. Sell Stock Photos or Videos

Selling stock photos or videos involves creating visual content that businesses, marketers, and designers can purchase and use for their projects. Platforms like Shutterstock, Adobe Stock, and iStock allow you to upload and sell your media to a global audience.

Steps to Get Started:

- Choose a Niche: Focus on a specific niche, such as nature photography, lifestyle imagery, or corporate videos. Research what types of images or videos are in high demand on stock platforms.

- Invest in Equipment: Use a high-quality camera and editing software to produce professional-grade content. The better the quality, the more likely your media will be purchased.

- Create and Edit Content: Shoot a variety of photos or videos, keeping in mind the needs of potential buyers. Edit your content to enhance its appeal, using software like Adobe Photoshop for photos or Final Cut Pro for videos.

- Upload to Stock Platforms: Sign up for multiple stock platforms to increase your exposure. Upload your media, complete with detailed titles, descriptions, and keywords to improve discoverability.

- Track Sales and Earnings: Monitor your sales and earnings through the platform’s dashboard. Analyze which types of content sell best and adjust your strategy accordingly.

How to Sell Stock Photos Online

9. Rent Out a Spare Room

Renting out a spare room in your home can provide a steady stream of income, whether you’re renting to long-term tenants or short-term guests through platforms like Airbnb.

Steps to Get Started:

- Prepare the Room

- Determine Rental Terms

- List Your Room Online

- Set a Competitive Price

- Screen Potential Renters

- Manage the Rental

10. Create an App

Developing a mobile app can be a lucrative passive income stream if it addresses a need or provides entertainment. Once your app is live on platforms like the App Store or Google Play, it can generate revenue through ads, in-app purchases, or paid downloads.

Steps to Get Started:

- Identify a Problem to Solve: Think of an app idea that solves a specific problem or fulfills a need in the market 🧐. Research similar apps to ensure there’s demand for your idea 🔍.

- Learn or Outsource App Development: If you have coding skills, start building the app yourself 👨💻. If not, consider hiring a developer or using app development platforms like Appy Pie.

- Design the User Interface: Focus on creating a user-friendly and visually appealing interface 🎨. Tools like Sketch or Adobe XD can help you design your app’s layout 🖼️.

- Develop and Test: Build the app and rigorously test it for bugs 🐞 and usability issues 👨🔧. Ensure it works seamlessly across different devices and screen sizes.

- Publish and Market Your App: Once your app is ready, publish it on the App Store and Google Play. Use app store optimization (ASO) techniques to improve visibility and downloads 📈.

- Monetize Your App: Choose a monetization strategy that aligns with your app’s purpose 💵. Common options include ad revenue 📊, in-app purchases 🛒, and subscription models.

11. Create Print-on-Demand Products

Print-on-demand (POD) involves designing custom products like t-shirts, mugs, or phone cases that are printed and shipped by a third-party provider only after a sale is made. This eliminates the need for inventory and reduces upfront costs.

Focus on a specific niche or audience, such as pet lovers, gamers, or fitness enthusiasts. This helps you create designs that resonate with potential buyers.

Use graphic design software like Adobe Illustrator or Canva to create unique and eye-catching designs. Consider hiring a designer if you’re not confident in your design skills.

Sign up for a print-on-demand platform like Printful, Teespring, or Redbubble. These platforms integrate with e-commerce sites like Shopify, making it easy to sell your products. Upload your designs to the POD platform and choose the products you want to sell. Set your prices, taking into account production costs and your desired profit margin.

Market your products through social media, email campaigns, and paid advertising. Collaborate with influencers in your niche to reach a wider audience.

Monitor which products sell well and which don’t. Use this data to refine your designs and marketing strategies.

12. Rent Out Equipment

If you own high-demand equipment like cameras, power tools, or party supplies, you can rent them out to others. This is a great way to earn passive income from items you already own but don’t use frequently.

Start by taking stock of what you already have. Look around your garage or tool shed—what equipment do you own that’s in great shape and could be rented out to others?

Next, think about the common tasks and projects homeowners face, from routine maintenance to ambitious renovations. What tools do they need to get the job done? And more importantly, which of these tools are the kind that homeowners would rather rent than buy?

Here’s a list to spark some ideas:

- Versatile power drills for every drilling need.

- High-pressure power washers to clean surfaces like new.

- A variety of power saws for cutting through wood, metal, or tile.

- Drain snakes to tackle stubborn clogs with ease.

- Sturdy ladders for those hard-to-reach spots.

- Industrial-grade floor buffers for a polished finish.

- Heavy-duty wet/dry shop vacs to clean up any mess.

- Efficient weed whackers for taming unruly lawns.

- Powerful jackhammers for breaking through concrete.

- Reliable air compressors for all your pneumatic tools.

- Handy hand trucks to move heavy loads with minimal effort.

- Rugged cement mixers for construction projects.

- Precision grinders for sharpening and shaping.

- Smooth sanders for that perfect finish.

- Backup generators to keep the power on.

13. Create Digital Products

Digital products, such as printable planners, eBooks, and software, can be created once and sold repeatedly.

These products are delivered electronically, eliminating the need for physical inventory and shipping.

Sell your digital products on platforms like Etsy, Gumroad, or your own website. These platforms handle transactions and deliver the products automatically.

14. Buy a Vending Machine

Investing in vending machines can be a lucrative source of passive income. By strategically placing machines in high-traffic areas, you can earn money from each sale with minimal effort.

Steps to Get Started:

- Research the Market: Investigate which types of vending machines (e.g., snacks, beverages, healthy options) are in demand in your area. Determine the best locations, such as schools, offices, or gyms.

- Purchase a Vending Machine: Decide whether to buy a new or used vending machine. New machines are more reliable but cost more, while used machines are cheaper but may require repairs.

- Find Prime Locations: Secure a contract with a business or property owner to place your machine in a high-traffic area. Negotiate terms, including commission splits if necessary.

- Stock and Maintain the Machine: Regularly stock your vending machine with popular products and ensure it’s well-maintained. Keep it clean and in working order to attract more customers.

- Monitor Sales and Replenish Stock: Use tracking software to monitor sales and inventory levels. Replenish stock as needed to prevent the machine from running empty.

- Expand Your Network: As you gain experience and profits, consider purchasing additional machines and placing them in other lucrative locations.

15. Invest in a High-Yield Savings Account

A high-yield savings account (HYSA) offers higher interest rates compared to traditional savings accounts, allowing your money to grow passively over time.

Steps to Get Started:

- Research HYSAs: Compare interest rates, fees, and terms offered by various online banks. Look for accounts with no monthly fees and competitive APYs (annual percentage yields).

- Open an Account: Once you’ve selected a bank, open an account online. This process typically takes just a few minutes.

- Deposit Funds: Transfer money from your checking account or another savings account into the HYSA. Some banks may require a minimum deposit to open the account.

- Set Up Automatic Transfers: Set up automatic transfers from your primary bank account to your HYSA to ensure consistent contributions. This helps maximize your interest earnings.

- Monitor Your Account: Keep track of your balance and interest accrual through your online banking portal. Regularly compare your HYSA’s rate with others to ensure you’re getting the best return.

- Consider Other Financial Goals: Use your HYSA to save for short-term goals like an emergency fund or a major purchase, while earning more interest than a traditional savings account.

16. Purchase a Blog or Website

Instead of building a website from scratch, you can purchase an established one that already generates income. Websites like Flippa offer a marketplace for buying and selling blogs, e-commerce sites, and other online businesses.

What to Look For: Established traffic, revenue streams, and potential for growth.

Pro Tip: Perform due diligence before purchasing to ensure the website is legitimate and aligns with your goals.

17. License Your Photos or Music

Licensing your creative work, such as photos or music, allows you to earn royalties whenever it’s used by others. This is a popular passive income stream for photographers, musicians, and artists.

How can you make money from AudioJungle

18. Start a Dropshipping Business

Description: Dropshipping is an e-commerce model where you sell products without holding inventory. When a customer places an order, you purchase the item from a third-party supplier who ships it directly to the customer.

What is dropshipping?

Dropshipping is a retail method where an online store doesn’t keep its products in stock. Instead, when a customer makes an order, the store forwards it with payment to a dropshipping supplier. The supplier then ships the product to the customer.

Many business owners prefer dropshipping because it passes the task of order fulfillment to suppliers.

This means stores don’t need to invest in warehouse space or risk getting stuck with unsold inventory.

As a result, businesses can allocate more resources to other retail activities such as marketing.

It’s estimated that dropshipping generates more than $300 billion in ecommerce sales every year

19. Rent Out Your Car

If you have a car that you don’t use often, renting it out through platforms like Turo or Getaround can generate passive income. This is an excellent option for people living in urban areas where car rentals are in high demand.

Steps to Get Started:

- Sign Up on a Car Rental Platform: Create an account on Turo, Getaround, or another car-sharing platform. Fill in your vehicle’s details, including make, model, and condition.

- Set Your Availability: Specify the days and times your car is available for rental. Consider making it available during peak travel times or weekends to maximize earnings.

- Price Your Car Competitively: Research similar vehicles in your area to set a competitive rental price. Some platforms offer dynamic pricing tools to help you optimize your rates.

- Prepare Your Car: Ensure your car is clean, well-maintained, and filled with fuel before each rental. Consider installing a GPS tracker for added security.

- Manage Bookings and Communication: Respond promptly to rental requests and communicate clearly with renters. Provide detailed instructions for pick-up and drop-off.

- Collect Payments and Reviews: After each rental, inspect your car for any damage. Collect payments through the platform and encourage renters to leave positive reviews to attract more customers.

20. Create a Podcast

Podcasting has become a popular medium for sharing information and stories. Once your podcast gains a following, you can monetize it through sponsorships, ads, or listener donations via platforms like Patreon.

Popular Formats: Interviews, storytelling, or educational series.

Pro Tip: Consistency is key—release episodes regularly to build a loyal audience.

21. Create a Subscription Box

Subscription boxes are curated packages of products delivered to subscribers on a regular basis. This model has gained popularity across various niches, from beauty products to snacks to books.

Niche Ideas: Fitness gear, eco-friendly products, or pet supplies.

Pro Tip: Start with a small, targeted audience and gradually scale as you refine your offerings and business model.

Final Thoughts

Diving into passive income opportunities can be life-changing, especially for beginners looking to enhance their financial stability.

Each of these 21 ideas offers a unique path to generating income with varying levels of involvement, risk, and reward.

“Remember, the key to success in passive income is consistency, patience, and continuous learning.”

Start small, scale up gradually, and you’ll find yourself on the road to financial freedom in no time.

To stay informed and keep up with the latest developments, bookmark Ecomsity and visit regularly for updates.