Have you ever been stuck in the cycle of saving little or nothing, no matter how hard you try?

I have too.

But in the last 90 days, I saved $10,000 and that was due to a secret: a centuries-old Japanese budgeting method called “Kakeibo” (pronounced kah-keh-boh).

It made me really, really be in control of my spending and mind all my finances to save toward my goal within a timeframe that even the most optimistic person would say it wasn’t possible.

So, here’s how it works, and you can do this too.

The acts of mindful spending and saving are so interconnected with each other that small changes using kakeibo have cumulatively impacted my bank account.

What is Kakeibo? 🏯

Kakeibo is the Japanese term for “household financial ledger.” It is a very simple yet effective way to monitor your income, expenses, and savings goals.

The method was developed in 1904 by a Japanese journalist named Hani Motoko. The approach is based on mindful spending and self-discipline.

Unlike most budgeting apps or spreadsheets, Kakeibo emphasizes writing everything down manually, which makes you more conscious of your habits.

Where did kakeibo come from?

While kakeibo is relatively new to the United States, it is an ancient tradition in Japan.

A 1904 women’s magazine features the method of kakeibo accounting by a Japanese journalist called Hani Motoko.

This appealed to her Japanese readers who happened to be housewives charged with family budgeting responsibilities.

When in 2018, Fumiko Chiba published the guide called Kakeibo: The Japanese Art of Saving Money, the practice took off on the other side of the globe.

As Chiba and other experts suggest, kakeibo reflects the belief of Japanese culture that saving money is a way of life.

Cash has a ceremonial use. Children receive money as a holiday gift, and they are encouraged to hold onto the cash for purchases worth it.

Adults don’t take money lightly either. In contrast to other nations, Japan is a cash-heavy economy.

Credit cards, which facilitate frequent, big-ticket spending aren’t swiped nearly as often as elsewhere.

How Kakeibo Changed My Financial Life 💡

I was already using apps to track my money before finding Kakeibo.

However, I would get many notifications that I just would swipe through without opening it up and taking a look.

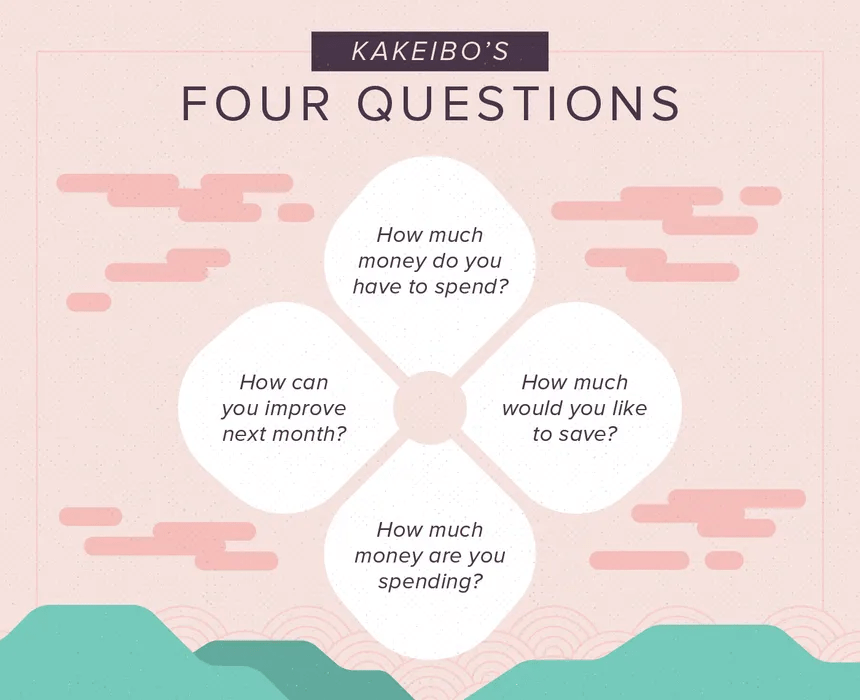

In my experience with Kakeibo, every month, I had to answer four crucial questions:

1. How much money do I have?

I had to record the total amount of income for the month, which could include side hustles.

Track your income and expenses for a specific period.

Before you can make good changes in any part of your life, you must understand what you are working with, so the first step is documenting financial habits for a given time period.

You also could compare your overall income to cost of living with another city and/or state. This can be done with the use of a cost-of-living calculator.

A month would be a good period to start off with. You need to document all of your fixed expenses and income for this period.

2. How much do I want to save?

Set a savings target, of course. My target savings was $3,333 per month to achieve saving $10,000 for 90 days.

Once you have decided on the fixed expenses and income, you put aside the remainder for your savings goal, which falls under the saving category.

This post contains a template you can use, and you can get that template delivered to your inbox by completing the opt-in form.

3. How much am I spending?

Break down your expenses like food, transportation, house rent, and entertainment.

Now that you know where your money is going, the next step is to create four different categories within which each expense has a home.

Kakeibo method includes four-pillar categories that you need to focus on:

- Needs

- Wants

- Culture

- Unexpected

4. How can I improve?

This part was critical too. At the end of every week, I revised where I overspent and tweaked my habits.

The Kakeibo budgeting method aims at the reflection of what you have done right and what went wrong in your budget during the month.

You can take a minute to reflect on your financial decisions and note down ways you can improve in the month that follows.

If you achieved it, good job. Take some time to set a new target.

If you didn’t achieve it, take your time to pinpoint what led you astray and be ready to step forward with it.

Also, track your progress by asking the questions to yourself:

- How much money have you gotten?

- How much do you want to put aside in this month?

- How much money are you spending?

- How can you improve?

If you ask yourself that question, it will remind you of your priorities and even show you how your financial priorities change over time.

My 90-Days Journey 🚀

Here’s a detailed look at what I did over the three months:

Month 1: The Awareness Phase 🧐

I started by just recording every penny I spent.

Yes, it was a bit tedious at first, but I realized how much I was spending on non-essentials like eating out and online shopping.

Month 2: The Adjustment Phase 🔄

Month 2: The Adjustment Phase 🔄

I cut down by cooking meals at home and started a “no-spend weekend” challenge.

With my spending data by my side, I adapted:

- Begged started using public transport from rideshares

- Canceled all unnecessary subscriptions (goodbye, 3 more streaming services I barely used!),

- Started a “cash-only” system for weekly grocery shopping not to overspend.

Month 3: The Maximization Phase 💪

This was the game changer:

- Sold on unused items on platforms Facebook Marketplace.

- Started freelancing on weekends to increase my salary.

- Treated myself to free activities such as hikes or library visits instead of costly outings.

Tools That Helped Me 📚

I utilized a basic notebook with special sections for income, expenses, and savings.

2. Budgeting Categories

I segmented expenditure into:

- Needs: These expenses are non-negotiable. You cannot get rid of them-debt payments, student loans, mortgage payments, rent, groceries, medical insurance, etc.

- Wants: These expenses can be bargained and have them taken away- the Starbucks coffees, the takeout, drinks out with the girls, and so forth. They bring happy feelings to you, but these are something you don’t need as such.

- Culture: Anything that entertains you would be part of culture expenses- Netflix, movies, music, museum tickets, a puppet show, a drive-in theatre, etc.

- Unexpected: Self-explanatory- you have not accounted for these expenses and there is no way to account for them other than setting aside a percentage of your income every month for a rainy day. Examples would be a medical bill you did not see coming, a problem with your car engine, or a leak in your bathroom.

3. Weekly Reviews

Each Sunday, I reviewed my progress, keeping me encouraged.

My Final Savings Breakdown

| Category | Monthly Savings | Total (90 Days) |

|---|---|---|

| Reduced dining out | $800 | $2,400 |

| Sold unused items | $700 | $2,100 |

| Cut subscriptions | $200 | $600 |

| Side hustle earnings | $1,000 | $3,000 |

| Public transport savings | $300 | $900 |

Why Kakeibo Works?

I think the beauty of Kakeibo is how it’s simple. Putting down everything made me more conscious about every dollar I was spending.

It taught me that there is a difference between “needs” and “wants” and gave me some control over my finances.

How You Can Start Today 🖊️

- Get a Notebook: It doesn’t have to be fancy. Start with what you have.

- Define Your Goal: Be specific about how much you want to save and why.

- Track Expenses: Write down every single expense, no matter how small.

- Reflect Weekly: Analyze your spending and look for areas to cut back.

- Stay Consistent: Make it a daily habit to check in with your finances.

Final Thoughts

Initially, it was very hard and impossible to believe that anybody could save $10,000 in 90 days.

But with Kakeibo, all that is not only possible but easy and actually very simple if one stays focused and intentional about how much attention is paid to each of those dollars.

This will surely help in breaking up the stress caused by these monetary problems and perhaps bring more excitement when seeing these savings.

Are you ready to take the reins on your finances with Kakeibo?

Let’s get started with Ecomsity! Share your journey in the comments below!!!