In those four months, I keep remembering the day when my bank account balance was but a handful of money barely enough to save.

What’s worse, I could recall how I was only in my job as a software engineer in a startup after earning a decent but nowhere near extravagant salary.

No matter how hard I struggled, it didn’t indicate or reflect my savings. Then, that was a wake-up call for me.

I had dreams, ambitions, and even simple financial goals, but I was barely making a dent in any of them. It was then that I became serious about budgeting.

During these four months, I saved $20,000. It is a huge amount for me, and I am amazed to see the extent of impact a simple budgeting strategy had in my life.

Today, I want to share my story along with the exact budgeting methods that I applied, along with examples of how day-to-day tracking and planning made it possible.

Turning Point

I was working at a startup as a middle-class guy, and budgeting was something I never imagined I would do so intensely.

I thought I was handling my finances just fine, as I was not blowing money on some luxury vacations or buying something extravagant.

However, the small and frequent expenses were eating away at my salary, and I wasn’t even realizing it.

That was my wake-up moment, and from then onwards, I resolved to save consistently with a clear plan.

My goal was ambitious but doable: I wanted to save $20,000 in four months.

This meant I would be saving approximately $5,000 per month, which I knew pretty well would mean cutting down and sticking to my budget like glue.

Setting Up My Budgeting System

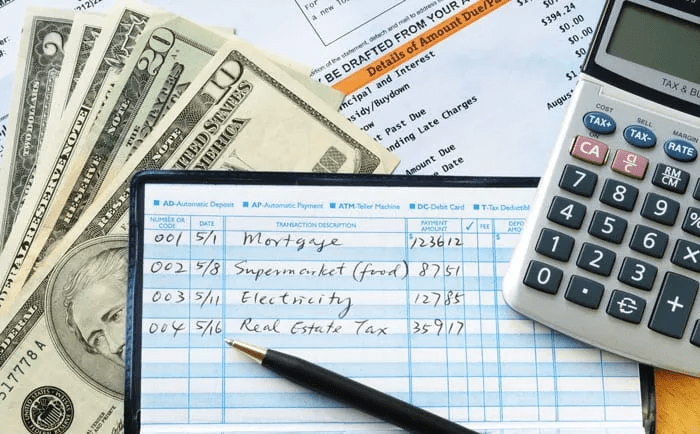

The first thing I did was create a simple budgeting spreadsheet. I didn’t want anything complicated that would overwhelm me; I just needed something clear and actionable.

My budget sheet included categories for income, fixed expenses, variable expenses, and savings, which I would track daily.

Here’s a sample of the monthly budgeting sheet I used:

| Category | Description | Budgeted Amount | Actual Amount | Difference | Notes |

|---|---|---|---|---|---|

| Income | |||||

| Salary | Main job income | $4,000 | |||

| Freelance Income | Side projects | $500 | |||

| Bonus / Other Income | Additional earnings | $100 | |||

| Total Income | $4,600 | ||||

| Expenses | |||||

| Fixed Essentials | |||||

| Rent | Monthly rent payment | $1,200 | |||

| Utilities | Electricity, gas, water | $150 | |||

| Internet & Phone | Monthly bills | $80 | |||

| Insurance | Health, car, renters, etc. | $120 | |||

| Groceries | Food and household items | $400 | |||

| Flexible Essentials | |||||

| Dining Out | Eating out/takeout | $100 | |||

| Entertainment | Movies, games, subscriptions | $50 | |||

| Personal Care | Haircuts, skincare, etc. | $40 | |||

| Transportation | Fuel, public transit | $200 | |||

| Sinking Funds | |||||

| Car Maintenance | Set aside for car repairs | $50 | |||

| Emergency Fund | Backup for unexpected expenses | $200 | |||

| Vacation Savings | Funds for upcoming travel | $150 | |||

| Total Expenses | $2,740 | ||||

| Savings & Investments | |||||

| Emergency Fund | Savings for emergencies | $300 | |||

| Investment Account | Stocks, retirement, etc. | $500 | |||

| High-Yield Savings | General savings account | $300 | |||

| Total Savings | $1,100 | ||||

| Miscellaneous | |||||

| Fun Money | Small splurges, coffee, etc. | $60 | |||

| Gifts | Birthdays, special occasions | $50 | |||

| Total Miscellaneous | $110 | ||||

| Summary | |||||

| Total Income | $4,600 | ||||

| Total Expenses | -$2,740 | ||||

| Total Savings & Investments | -$1,100 | ||||

| Total Miscellaneous | -$110 | ||||

| Net Balance | $650 | Remaining funds after budget allocations |

Daily Tracking for Immediate Awareness

Daily tracking was a game-changer for me. Each evening, I’d go through my expenses for the day, no matter how small.

The goal was to capture every purchase, even the $2 coffee I grabbed on my way to work. Here’s how my daily tracking looked:

| Date | Category | Description | Budgeted Amount | Actual Spent | Difference | Notes |

|---|---|---|---|---|---|---|

| Nov 1 | Groceries | Weekly grocery shop | $50 | $45 | +$5 | Stayed under budget! |

| Nov 1 | Transportation | Gas | $20 | $20 | $0 | |

| Nov 1 | Dining Out | Coffee with friends | $15 | $18 | -$3 | Splurged on an extra coffee |

| Nov 2 | Personal Care | Haircut | $30 | $30 | $0 | |

| Nov 2 | Entertainment | Movie rental | $5 | $5 | $0 |

This daily method kept me in check. It wasn’t always easy to resist that extra coffee or movie ticket, but knowing I’d have to log it at the end of the day made me think twice.

How I Managed the $20,000 Within 4 Months

- Target Monthly

- In order to save up the $20,000 within four months, it became easy to put away about $5,000 every month. In this way, I was constantly in the limelight without confusing and worrying.

- Monthly Target: $5,000

- Weekly Target

- Going further on that is breaking down $5,000 monthly targets to the ones on a weekly basis which would make it easy to track.

- Weekly Target: $5,000 ÷ 4 weeks = $1,250 per week

- Daily Savings Target

- I wanted to be even more specific; I set a daily target. I found that it was essential to monitor daily expenditure, and a clear target for the day helped keep my savings steady.

- Daily Target: $1,250 ÷ 7 days ≈ $179 per day

Lessons I Learned and Tips That Worked

Tracking Daily Builds Accountability

Every dollar counts. Tracking my spending daily really helped me in controlling the impulse buys and budgeting in such a way that it became more of a lifestyle than a sacrifice.

Realistic Goal Setting

I had decided to save $20,000 in four months. However, it was hard to do without a realistic budget. This made me start with small changes and keep the process sustainable and achievable.

Savings First

I treated savings as an expense instead of what was left at the end of the month. I transfer $1,100 directly to savings each time it is payday.

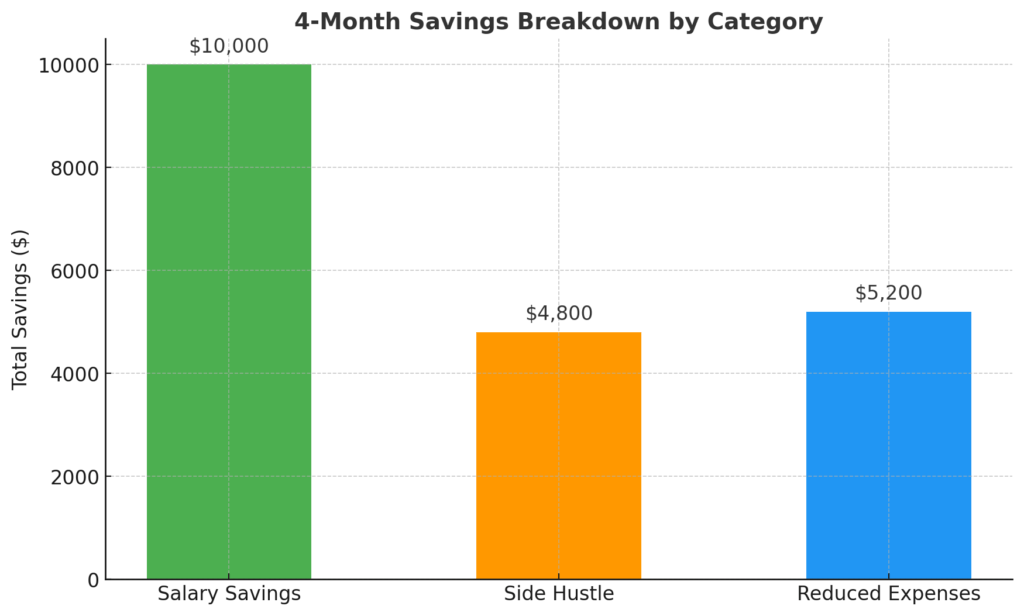

Breakdown of How I Saved $5,000 Each Month

Here’s exactly how I adjusted my monthly spending and income sources to make saving $5,000 each month feasible. I achieved this by combining my regular income, a side hustle, and spending cuts.

| Category | Monthly Goal | Monthly Savings Achieved | How I Did It |

|---|---|---|---|

| Salary Savings | $2,500 | $2,500 | Allocated a fixed 50% of my monthly paycheck |

| Side Hustle | $1,200 | $1,200 | Freelance projects added $300 per week |

| Reduced Expenses | $1,300 | $1,300 | Cut down on dining, shopping, and entertainment |

Total Monthly Savings: $5,000

This segmentation helped me hit my target of $20,000 in four months with a clear, structured plan. Here’s how every segment contributed to my target of monthly savings:

Ordinary Salary Savings ($2,500):

I planned to save half of the amount I received as pay every month. I set it up so that this was transferred automatically to my savings account on payday, saving this amount before I could use it.

Side Hustle Earnings ($1,200):

I gained extra income from taking freelance work. I targeted more minimal, more palatable projects that earned about $300 a week, right into my savings.

Expenses Cut ($1,300):

Elimination of less-than-essential costs like dining out, entertainments, and fewer shop visits helped me remove $1,300 per month. This was done by replacing night outs with free activities and cooking more meals at home; focus on what was only necessary.

All these helped me succeed in hitting the savings goal due to steady persistence on my part.

Total Savings after 4 Months = $5,000 * 4 = $20,000

It has done wonders for me. I had to work hard, be disciplined, and exercise self-control.

However, seeing all these savings results in my bank account, every little sacrifice is now all worth it.

And today, with the saving of $20,000, I can sense a kind of freedom with money that opens up more opportunities than I ever dreamt of.

How to Try This Yourself

As you start on this journey, remember these important words: budgeting isn’t about limitations, but about liberation.

Knowing where your money goes means you are free to place it exactly where it matters most to you.

Since I started with this process, I realized that not only was the savings goal attained but I had a firmer grip on finances.

It’s not complicated or fancy but works. Do follow Ecomsity for more.