Hello! Are you drowning in debt?

Feel like you’re about to get submerged and unable to breathe? Take a seat, inhale some fresh air, and relax.

I was once in your shoes, drowning in $90,000 of debt and barely scraping by on a $6,000 monthly paycheck.

But guess what? I paid it all off, and so can you! This blog will guide you step by step on how debt settlement helped me eliminate my debt, and how it can help you do the same.

What is Debt Settlement?

Debt settlement involves negotiating with creditors to reduce the amount owed. The idea is to offer a lump-sum payment that is less than the full balance.

Typically, settlements can range from 50% to 60% of the original debt. In my case, I was able to settle for around 55% of the total debt.

Step 1: Know Your Debt Situation 📝

Before diving into debt settlement, get a clear picture of your debts:

- Write Down All Debts: Include everything—credit cards, medical bills, personal loans, etc.

- Note the Amount Owed: List the outstanding balance for each debt.

- Identify Interest Rates: Make a note of the interest rates and minimum monthly payments.

Why this matters: It allows you to prioritize which debts to settle first.

Step 2: Create a Realistic Budget 💸

You’ll need a budget that outlines exactly where your $6,000 paycheck is going. Here’s how I structured mine:

| Expense Category | Monthly Allocation ($) |

|---|---|

| Living Expenses (Rent, Groceries, Utilities, etc.) | 2,500 |

| Debt Payments | 1,800 |

| Savings for Settlement Offers | 1,200 |

| Personal Spending | 500 |

| Total | 6,000 |

This breakdown helped me visualize my spending and set aside funds for debt settlement.

Step 3: Contact Creditors 📞

Now that you’ve saved some money, start negotiating with creditors. Here’s how I approached it:

- Start with the Oldest Debt: Older debts are more likely to be settled for less.

- One-Time Deal: Offer a lump-sum payment of 40% to 60% of the total balance. For example, I offered $4,000 to settle an $8,000 debt.

- Document the Agreement: Get written confirmation from the creditor stating that the payment settles the debt in full.

Step 4: Pay Off One Debt at a Time 📈

Focus on settling one debt at a time to maintain momentum. Here’s my strategy:

- Target Smaller Debts First: This gives you quick wins and boosts motivation.

- Apply Savings to the Next Debt: Once a debt is paid off, allocate that freed-up payment to the next one.

- Repeat the Process: Continue until all debts are settled.

Step 5: Monitor Your Credit Score 📊

Debt settlement will affect your credit score because settled debts are reported as “paid for less than the full amount.” However, this is still better than having unpaid debts or filing for bankruptcy. Here’s how to recover your credit:

- Pay Other Bills on Time: A good payment history will help boost your score.

- Use a Secured Credit Card: Once your debts are settled, start rebuilding your credit.

Calculation Breakdown: How I Paid Off $90,000 Debt

Initial Debt: $90,000

Settled Amount: ~$49,500 (around 55% of the total debt)

Time Frame: 17 months

Here’s how it worked:

- Total Debt Settlement Target: $49,500

- Monthly Debt Payment Allocation: $1,800

- Monthly Savings for Settlement Offers: $1,200

- Total Monthly Allocation for Debt: $3,000

- Months Needed to Save $49,500: $49,500 / $3,000 = 16.5 months (approximately 17 months)

Step-by-Step Example for a Single Debt Settlement:

- Debt Amount: $8,000

- Negotiated Settlement: $4,000 (50% of the original debt)

- Time to Save for Settlement: 2 months ($3,000/month towards settlement)

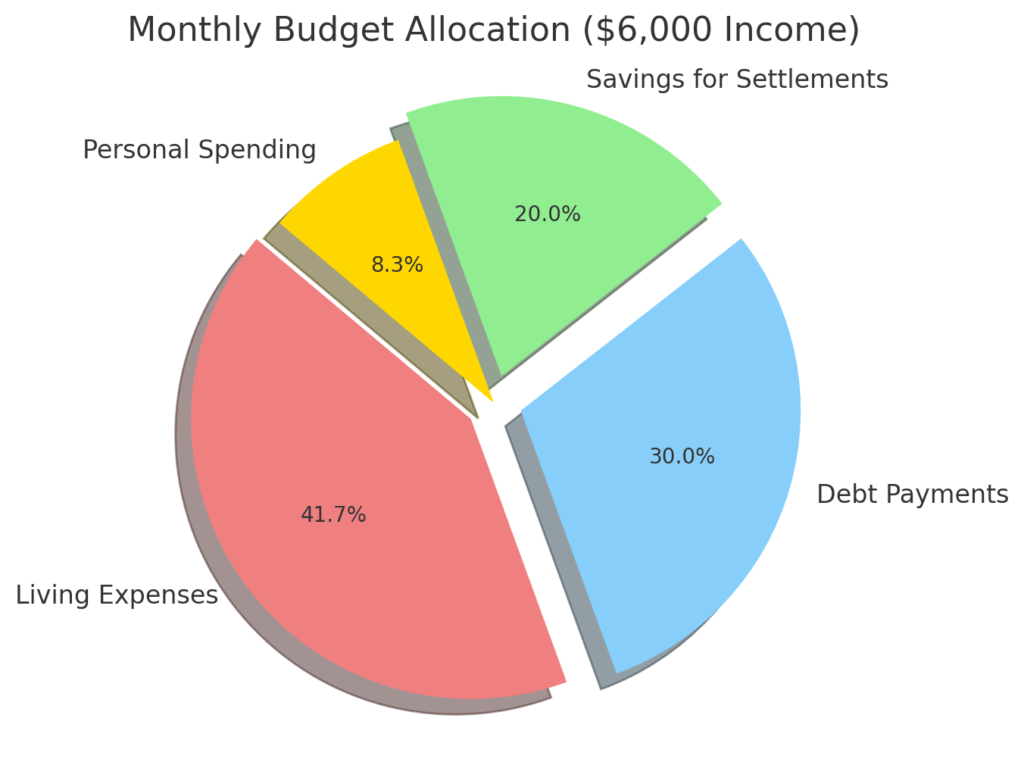

Visual Illustrations: Your Journey to Debt Freedom

1. Monthly Budget Allocation

- Living Expenses (41.7%): Covers essentials like rent, groceries, utilities, and transportation.

- Debt Payments (30%): Dedicated monthly amount to actively pay down debt.

- Savings for Settlements (20%): Set aside for lump-sum payments to creditors.

- Personal Spending (8.3%): Provides some flexibility for daily needs.

The pie chart below shows how each dollar of your $6,000 paycheck can be effectively used:

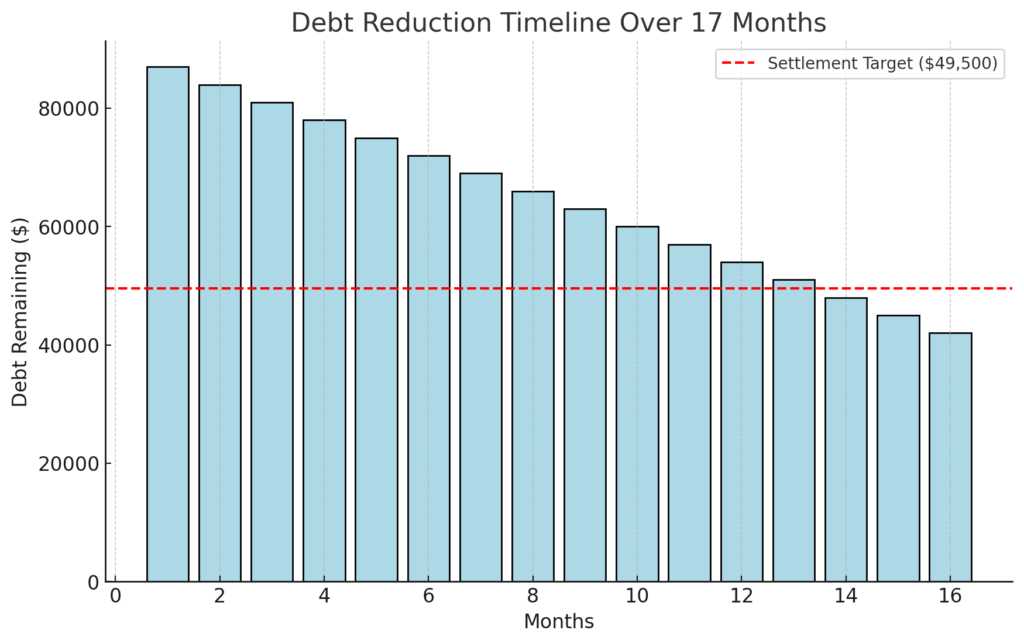

2. Debt Reduction Timeline Over 17 Months

- This chart tracks the debt remaining each month over a 17-month period.

- The red dashed line represents the settlement target of $49,500, showing the point where the debt will be considered settled.

- As monthly payments reduce the total debt, the graph illustrates progress toward the goal.

These graphs illustrate how structured budgeting, and consistent payments can steadily reduce debt, helping you visualize your path to financial freedom.

Frequently Asked Questions ❓

Is debt settlement better than bankruptcy?

Yes. Bankruptcy can remain on your credit report for up to 10 years, while settled debts may stay for around 7 years, with less stigma.

Do I need a debt settlement company?

No, you can negotiate settlements yourself and save on fees.

What if creditors won’t settle?

Keep trying. Persistence is key. If one creditor declines, move to the next one and revisit them later.

Important Tips to Make It Work 🔍

- Negotiate the Settlement Offer: Don’t accept the first offer. Aim for 40%-50% of the original amount.

- Increase Your Savings: Cut down on non-essential spending to save more for settlements.

- Stick to the Budget: Consistency is crucial to success.

Final Thoughts🎯

Debt settlement is not a quick fix; it requires discipline, persistence, and the right mindset. Reward yourself for each milestone, no matter how small, and keep your eyes on the goal.

This is your chance to reclaim your financial freedom.

Start today and take control of your life by visiting Ecomsity !🌟